The Bull Run in Property & Casualty (P&C) Insurance Continues

But Not All P&C Insurance Companies Will Benefit

A recent article “State Farm Seeking Large Rate Increases in Wildfire-Prone California” caught my attention and raised alarm bells regarding the financial condition of the largest P&C insurer in California (State Farm insures about 20% of all California homes) and indeed the largest P&C insurer in the country (NAIC 2024 Market Share Report). Apparently State Farm is requesting a 30% rate increase for its homeowners line, a 52% rate increase for renters and 36% rate increase for condo coverage - that’s a year after the carrier got California rate approvals of 7% and 20%—adding fuel to a burning homeowners crisis in a state that’s seen an increasing number of carriers pullback or raise rates in the last year.

State Farm is not doing well - they reported a monster $14.1 billion underwriting loss in FY2023 and that’s after a $13.2 billion underwriting loss in FY2022.

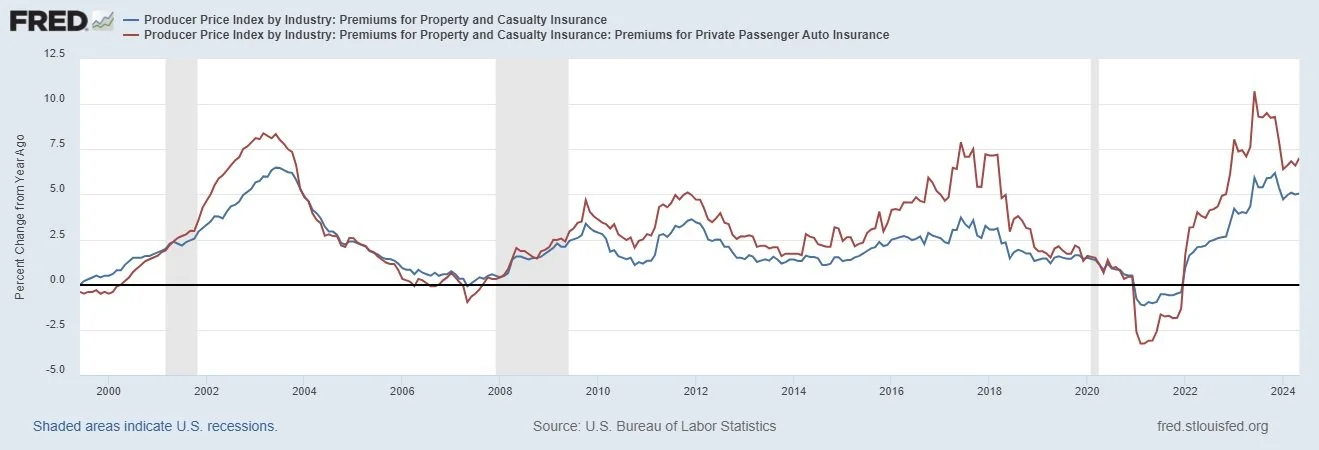

Which P&C insurers are earning underwriting profits? The U.S. P&C insurance market has been on a tear for the past several years - and recent May 2024 premium data continues to demonstrate strength with lines like personal auto up over 7% year over year.

Take a look at a well run P&C re-insurer such as Arch Capital Group Ltd. (ACGL) which has been generating underwriting profits for the past decade -most recently in 1Q2024 ACGL grew revenues at a 29% annual rate and generated returns on book equity over 29% while the stock trades at 8x earnings.