Eaglestone Capital

Shelter from the Storm

P&C Insurance - Kinsale Capital | 6.7.24

Every Dog Has His Day

While Nvidia grew earnings and book value per share at compound annual growth rates of 55% and 30% respectively over the past 9 years (impressive!), we’ve been thinking about how attractive the U.S. P&C insurance industry has been for the past few years.

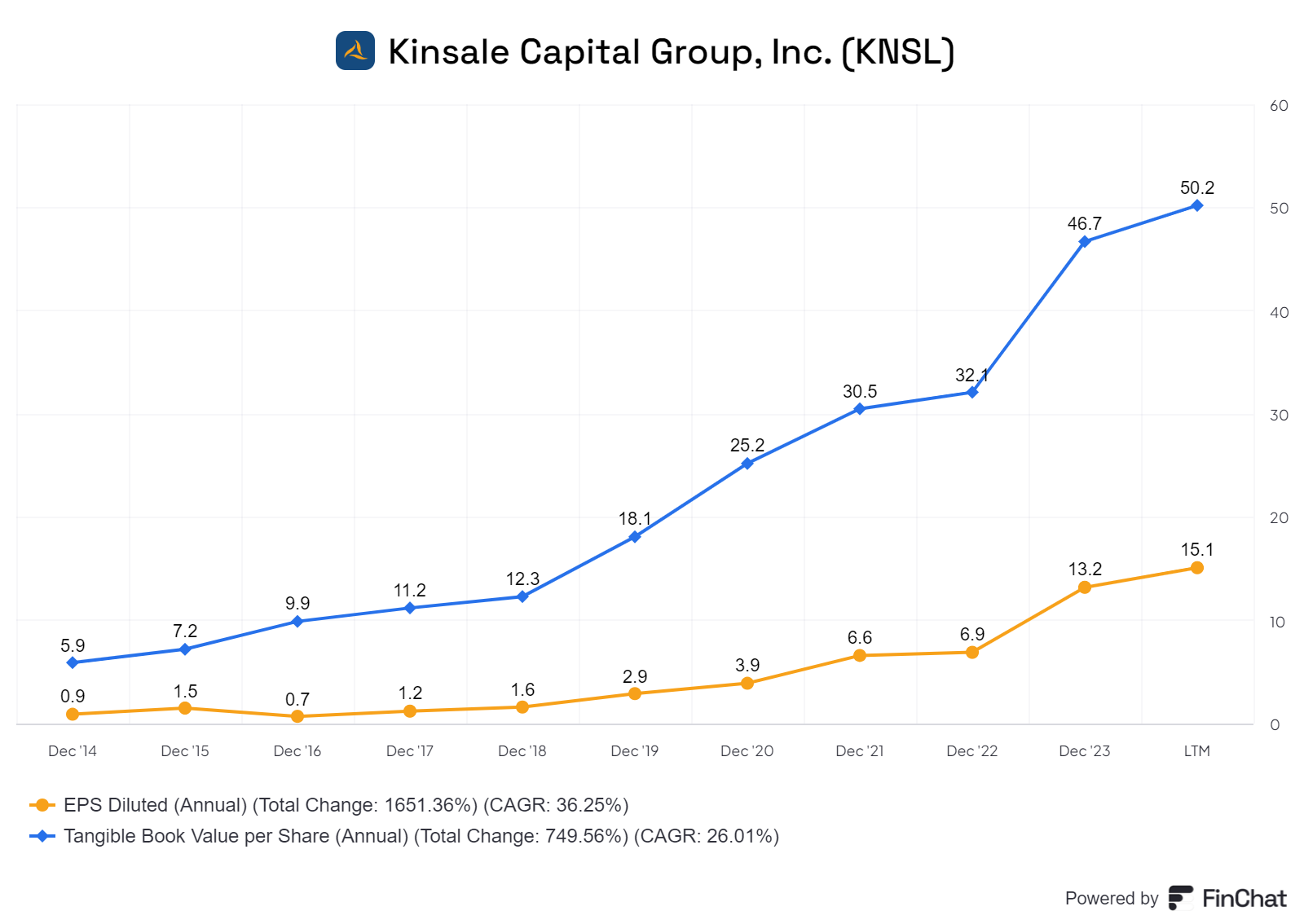

Take Kinsale Capital (KNSL) for example. The Virginia-based specialty P&C insurance company only underwrites smaller risks within the E&S market. The management team has grown EPS and book value per share at a CAGR of 36% and 26% over the past year while the shares have appreciated at a CAGR of 47%.

Retire Rich & Happy

Retailer in the Spotlight - Lululemon | 6.7.24

Lululemon Steals the Show

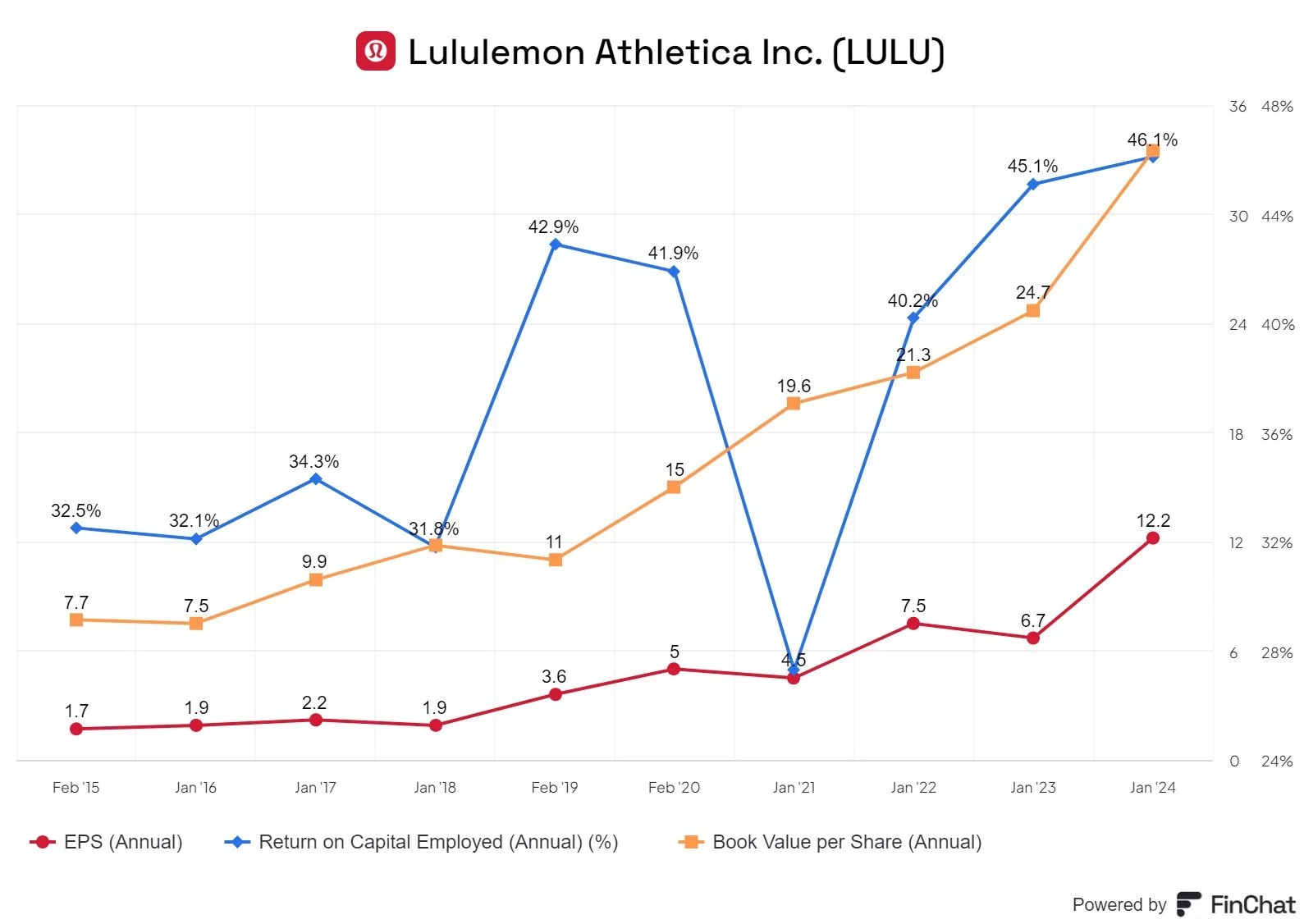

At Eaglestone Capital, we love companies that earn high returns on capital employed (ROCE) while growing earning per share (EPS) and compounding book value. Case in point, Lululemon (LULU) reported this week that it has grown EPS 7.2x, grown book value 4.5x and grown ROCE 44% over the past 9 years while their share price has compounded at an annual rate of 20% (returned 5.1x the original share price). As of June 5, 2024, the Company had approximately $1.7 billion remaining authorized under its stock repurchase program.